What’s the most painful part of your sales process?

You might think that it’s finding new leads or getting a decision maker to say ‘yes’. But have you considered the long and often difficult struggle that takes place after all that: actually collecting your payments?

First, you have to determine how your client wants to pay. If they want to use a credit card, your sales team probably creates an invoice in a separate system and sends it by email. The client contacts your accounting department and pays the bill, then accounting notifies sales, sales marks it as paid in the CRM, and so on… and the process could be entirely different (but just as clunky) if the client chooses a different payment method.

Sounds pretty inefficient, doesn’t it?

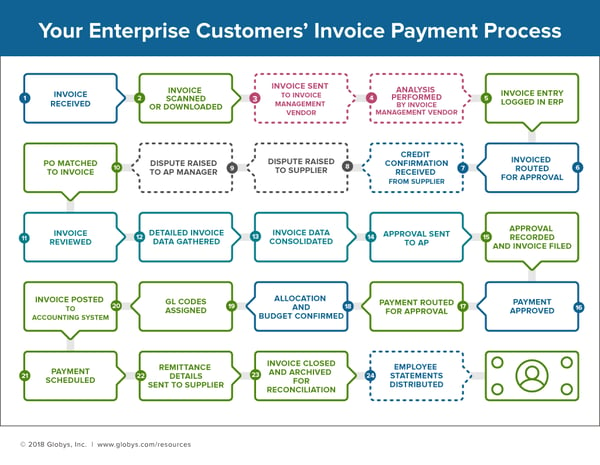

Here’s another example of a hypothetical payment process. It illustrates how a simple invoice payment can turn into a whopping 24 steps:

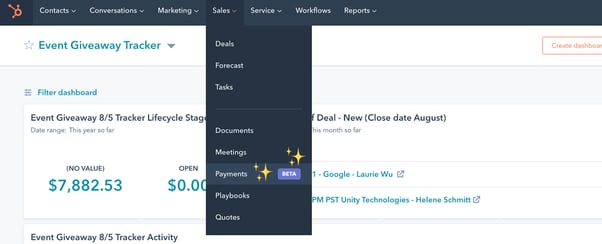

At the recent Inbound 2021 conference, HubSpot introduced a new platform that we’re SO excited about to take the pain out of payments. Introducing HubSpot Payments.

What is HubSpot Payments?

HubSpot Payments is an end-to-end payment solution that’s built directly into the HubSpot CRM. According to HubSpot, it will allow you to “accept payments confidently and seamlessly with less time and fewer tools”.

Essentially, this means you’ll be able to take digital payments without writing code or dealing with painful integrations… no matter what it is you sell. Yes, that’s right: even if you’re a B2B company, you can accept payments online! That means no more transfers and paper checks.

This process will be more secure and streamlined since it will let customers make online purchases with their preferred method. It also makes it easy for them to complete a purchase and manage payments, including receiving receipts or refunds.

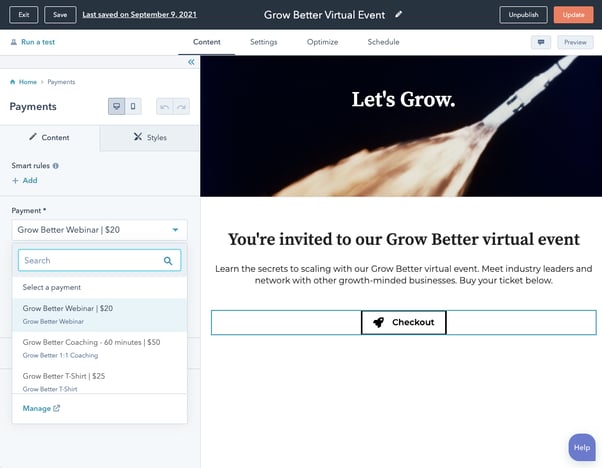

HubSpot Payments work primarily through payment links, which are unique, native URLs. Embed payment links on your website, send them in an email or live chat, or include them in your quotes. All your customers will have to do is click and pay!

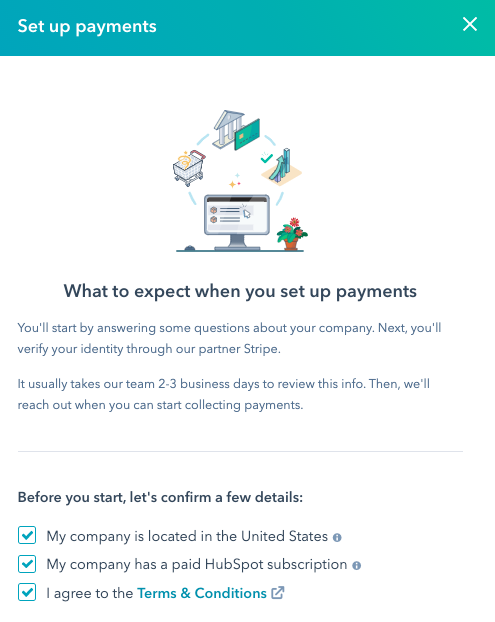

HubSpot Payments is powered through their partner, Stripe. When you begin setting up HubSpot Payments for your business, Stripe will verify some of your information.

If you run a subscription-based business, never fear: you’re able to set up regular recurring payments, too.

*Important note: At the time of publication, HubSpot Payments is only available to users located in the US, with a US bank account, and a paid HubSpot subscription. They’re working hard to bring the platform to Canada and the rest of the world soon.

Reducing friction in your sales process

Think about the payment process when you shop online on an ecommerce website. You choose what you want, add it to your cart, enter your credit card information, and boom! You’ve instantly paid for what you want and you know it will be on the way to you in a matter of days (or hours).

Now compare that to the typical buying process for a B2B product or service: First you go through a round of sales and demo calls with a team. Then you have to take their quote and get authorization. Sign a contract, send some money (often, even in 2021, with a check), and then wait for the money to arrive so you can start onboarding.

It might take weeks or even months after deciding to purchase before your payment is complete and you get what you pay for.

And customers don’t want to wait that long. They’re used to the instant, easy shopping process that ecommerce companies have nailed down. So why can’t they have it at work, too?

With HubSpot Payments, you can create a delightful and familiar experience for your customers. It will be easy for them to complete a payment on the spot with their preferred payment method. No more back and forth, no more delays, and no more outdated payment methods.

The sales process becomes so much smoother when customers can instantly make payments. There will be less risk of drop-offs since there are no delays, and it’s easier to convince someone to pull the trigger during a sales call if they can sign up and pay in a matter of moments.

The end result? They’ll be onboarded and loving what you do even sooner!

From an internal standpoint, HubSpot Payments reduces friction because it eliminates the need for integrations or other tools. Everything takes place within the CRM that your team already knows and loves.

Having trouble visualizing your sales process? Download our free sales pipeline template!

How to use HubSpot Payments in your business

There are plenty of ways to use HubSpot Payments to simplify your processes and make customers’ lives even better. Take a look:

1. Automate your payment process

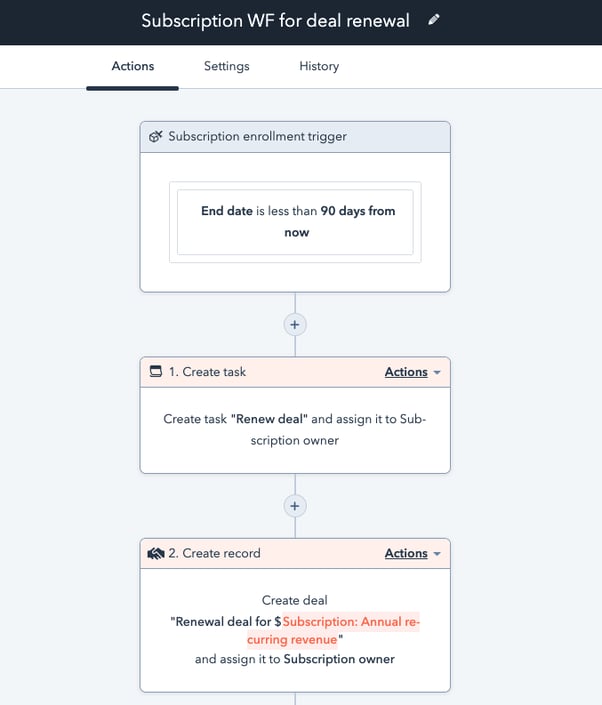

Tie payments into workflows to automatically handle all the back-end busywork like sending payment reminders and payment confirmations. Easily set up payment schedules and create deals to remind sales teams when it’s time to renew a contract.

With less time spent on manual and repetitive tasks, your team will have more time to help customers and seek out new revenue opportunities.

2. Combine payment data with customer data

Payments also easily integrates with reporting, deals, and analytics. That means you’ll have additional insight into your customers: who always pays right away, and who needs to be reminded?

You’ll also get a better picture of the effectiveness of your sales process. If you notice that a certain type of payment is never completed on time, you can dive into that problem and create a solution to improve your processes over time.

3. Empower your teams

With traditional payment methods, only one or two people may have access to the payment information and have an understanding of where individual clients stand.

By using Payments, you’re getting a full 360-degree view of each customer and every interaction they make with your business, including their payment information.

Marketing, sales, and customer service teams will be able to access this information in real-time and use it whenever they’re making decisions. They’ll be able to create more effective marketing campaigns, have more influence on sales calls, and help customers with their problems in less time.

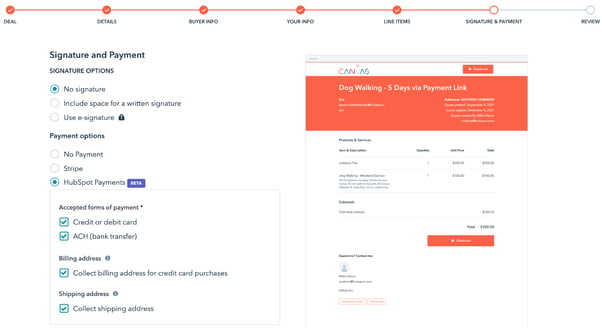

4. Integrate with quotes

Do you use HubSpot’s native quotes feature in Sales Hub? We have exciting news: the new Payments app comes with a native integration with these quotes.

You can embed a payment link in your quote for a customer to follow. Or, set it up so that as soon as they accept the quote, you get paid automatically! The streamlining opportunities here are endless.

5. Explore new revenue streams

Your customers are probably used to only paying through one or two payment methods. Have you ever considered if this limitation is turning away other potential customers?

With payment links, you can prompt and accept payments in ways that were never possible before: directly on your website, in an email, or during a live-chat conversation. This will likely encourage even more customers to work with you.

The more options you give customers to get paid, the more opportunities you have to expand and grow your revenue!

Ready to take payments in your business?

Are you excited about the new payments tool as we are? If you’re like us and just can’t wait, you can sign up here to get notified when it’s available.

Do you need help streamlining your sales process? Wondering how to build Payments into your online strategy? Get in touch with Horseshoe & Co. today to discuss any and all HubSpot needs.